Transferring a car title to a family member in California may seem daunting, but it’s a straightforward process once you understand the necessary steps. This process ensures that the new ownership is legally recognized, protecting both the giver and the receiver from potential legal and financial issues down the road. Whether you’re giving a car to your child as their first vehicle, transferring it to a spouse for shared ownership, or gifting it to a sibling as a generous gesture, handling the title transfer properly is crucial.

Failing to follow the correct procedures can lead to complications such as disputes over ownership, fines, or issues with future registrations and insurance claims. By adhering to the specific requirements set by the California Department of Motor Vehicles (DMV), you can ensure a seamless and compliant transition of ownership. Here’s a step-by-step guide to help you navigate the process smoothly, complete with tips and common pitfalls to avoid, so that you can confidently pass on your car without any hitches.

Why Transfer a Car Title to a Family Member?

Transferring a car title within the family can be for various reasons, each with its own significance and benefits. For many, gifting a vehicle to a family member—whether it’s a first car for a teenager, a reliable vehicle for an aging parent, or a secondary car for a spouse—can be an act of generosity that strengthens family support. Beyond gifts, transferring a title can also simplify estate planning by ensuring that vehicle ownership is clearly defined and passed down according to the owner’s wishes. This can help prevent potential disputes among family members and streamline the distribution of assets when managing an estate.

In addition, transferring a car title to reflect the primary driver is essential for accurate legal and insurance purposes. For instance, if a spouse or another family member becomes the primary user of the vehicle, updating the title ensures that the rightful individual is recognized as the owner, which can simplify insurance claims, registration renewals, and potential future sales.

Understanding the legal steps and requirements for transferring a car title is critical for ensuring the process is valid and compliant with California state regulations. Failing to adhere to these steps can lead to complications with the Department of Motor Vehicles (DMV), such as rejected applications, fines, or delays in processing. A thorough understanding of these procedures helps avoid potential issues and keeps the ownership transition smooth, transparent, and legally binding.

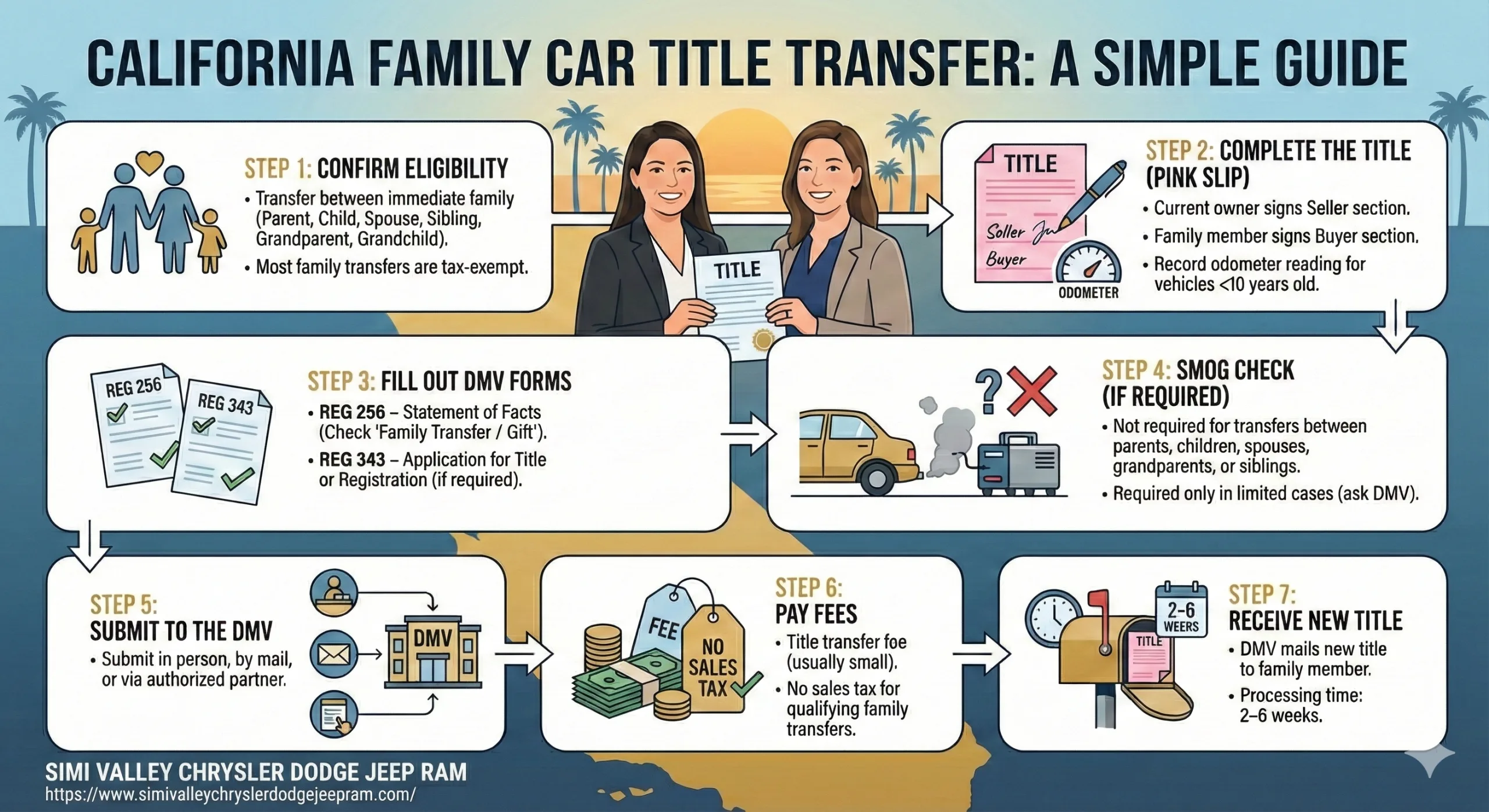

Step-by-Step Guide to Transferring a Car Title in California

1. Prepare the Necessary Documents

To initiate the transfer, gather these essential documents:

- The Current Vehicle Title: This is required to prove ownership.

- Smog Certification: Depending on the vehicle’s age and type, a smog check might be required unless the transfer is between parents, children, or spouses.

- Odometer Disclosure Statement: For cars less than 10 years old, you must report the current mileage.

2. Complete the Title

The current owner must fill out the relevant sections on the back of the title:

- Release of Ownership: The seller (current owner) needs to sign and date the release of ownership.

- New Owner Information: Include the full name and address of the family member who will be receiving the vehicle.

3. Fill Out a Transfer and Reassignment Form (REG 262)

This form includes sections for odometer disclosure, power of attorney, and vehicle transfer information. It’s essential for any title transfer and can be obtained from the DMV or online.

4. Complete a Statement of Facts (REG 256)

If the transfer is between family members, use the Statement of Facts form to declare the relationship and potentially avoid paying the use tax. California often waives the use tax for family transfers between parents and children or between spouses.

One of the primary benefits of using the REG 256 form is the potential to avoid paying the use tax, which can be a significant financial relief. California generally waives the use tax for vehicle transfers between qualifying family members, such as between parents and children, between spouses, or between domestic partners. This exemption makes transferring ownership more economical and straightforward for families.

When filling out the REG 256 form, it’s important to clearly state the relationship between the current owner and the new owner to meet the DMV’s criteria for tax exemption. Ensuring that the information is accurate and complete will prevent processing delays and potential issues with the transfer. Additionally, it’s wise to double-check that all accompanying documents, such as the vehicle title and odometer disclosure (if applicable), align with the information provided in the Statement of Facts form.

Overall, the REG 256 form helps streamline the transfer process and makes it more cost-effective for families, supporting smoother transitions of vehicle ownership while keeping within legal guidelines.

5. Submit Fees and Required Documents

Head to your local California DMV office or mail the completed paperwork. Typical fees include:

- Title Transfer Fee: This varies, so check with the DMV for current rates.

- Smog Fee (if applicable): If the vehicle requires a smog check.

Bring all completed forms, the original title, smog certification (if necessary), and a form of payment.

What to Expect After Submitting the Transfer

Once the DMV processes the paperwork, they’ll issue a new title with the family member’s name as the registered owner. This process may take a few weeks, so it’s important to keep a copy of the submitted forms or receipt for reference until the new title arrives.

Common Mistakes to Avoid

- Missing Signatures: Ensure both parties sign all required sections to prevent delays.

- Omitting the Smog Certification: Double-check if your transfer qualifies for a smog exemption.

- Incorrect or Missing Forms: Make sure you have filled out the REG 262 and REG 256 forms accurately.

Final Tips for a Smooth Transfer

- Plan a DMV Visit: Schedule an appointment to avoid long wait times.

- Double-Check for Errors: Review all forms before submission to prevent processing issues.

- Be Aware of the Deadline: Complete the transfer within 10 days of the change in ownership to avoid penalties.

Conclusion

Transferring a car title to a family member in California doesn’t have to be complicated. By following these steps and ensuring all paperwork is complete and accurate, you can make the process quick and hassle-free. Completing the transfer not only formalizes the new ownership but also provides peace of mind for both parties involved. Whether you’re gifting a car to help a family member save on their own vehicle purchase or formalizing shared ownership for easier management, the process represents more than just an administrative task—it’s an important step in supporting and connecting with those closest to you.

By taking the time to properly prepare and complete the necessary forms, you protect both yourself and your family member from potential legal and financial issues. Inaccuracies or missing information can lead to delays, penalties, or disputes that may complicate insurance coverage, future vehicle sales, or registration renewals. Ensuring that the car title is correctly transferred helps maintain clear ownership records, so the new owner can use, register, and insure the vehicle without any obstacles.

For more detailed guidance or to download essential forms, visit the official California DMV website or make a trip to your local DMV office. Many DMV offices offer helpful resources and customer support to answer your questions and guide you through the process.

By staying informed and prepared, you can ensure that the transfer process is seamless, straightforward, and worry-free for both parties. Taking these steps now can save time and stress later, allowing you to enjoy the benefits of transferring ownership with confidence and ease.